Bitcoin Shrugs At Fed Rate Cut As XRP, Dogecoin ETFs Set for Landmark US Debut

BTC holds near $117K after Powell’s move, but the spotlight turns to new products promising mainstream inflows.

Bitcoin prices edged higher in the early hours of Thursday, exhibiting a relatively muted move following the Federal Reserve’s first rate cut of the year.

The apex cryptocurrency was up 0.5% at $117,085 at the time of writing, while Ethereum was up 0.8% and XRP gained 1.6% over the past 24 hours, according to data from CoinGecko. Among other tokens, Solana gained 3.1% and Dogecoin was up 3.5%.

The U.S. central bank lowered benchmark interest rates by 25 basis points on Wednesday, with Fed Chair Jerome Powell citing the labor market weakness.

In a note released late Wednesday, Goldman Chief Economist Jan Hatzius said the firm expects two additional quarter-point reductions before the end of the year. The rate-setting arm of the Fed, known as the Federal Open Market Committee (FOMC), will meet twice more this year: on Oct. 28-29 and Dec. 9-10.

“The Federal Reserve cut rates for the first time in nine months. Bitcoin popped to US$117,200, then dipped to US$115,600 as traders did their classic ‘sell the news’ routine. More cuts are coming, but BTC’s still playing hard to get,” BTC Markets analyst Rachael Lucas said.

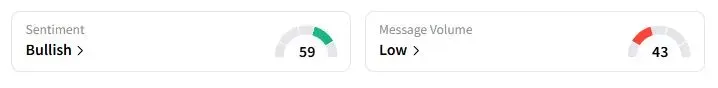

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

On Wednesday, the Securities and Exchange Commission approved rule changes demanded by the three major exchanges to adopt a generic listing standard for new cryptocurrency and other spot commodity exchange-traded products. This cleared a significant hurdle for crypto-focused ETFs, as the SEC earlier required a case-by-case review for any new listing.

“This is a watershed moment in America’s regulatory approach to digital assets, overturning more than a decade of precedent since the first bitcoin ETF filing in 2013,” said Teddy Fusaro, president of Bitwise Asset Management, according to a Reuters News report.

XRP, Dogecoin ETFs Gear Up For Landmark Debut

Later on Thursday, REX Shares and Osprey Funds will launch the first-ever U.S.-listed ETFs tied to XRP and Dogecoin on the Cboe BZX Exchange, under the ticker symbols XRPR and DOGE, respectively. Bloomberg ETF analyst James Seyffart had said earlier that they will not be “pure” spot ETFs but “will hold spot directly alongside spot XRP ETFs from around the world to get its exposure.”

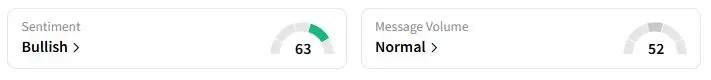

Retail sentiment on Stocktwits about XRP was in the ‘bullish’ territory at the time of writing.

“If inflows match the hype, analysts predict XRP could reach $4. Institutional doors are creaking open,” Lucas said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Get the daily crypto email you’ll actually love to read. It’s value-packed, data-driven, and seasoned with wit.