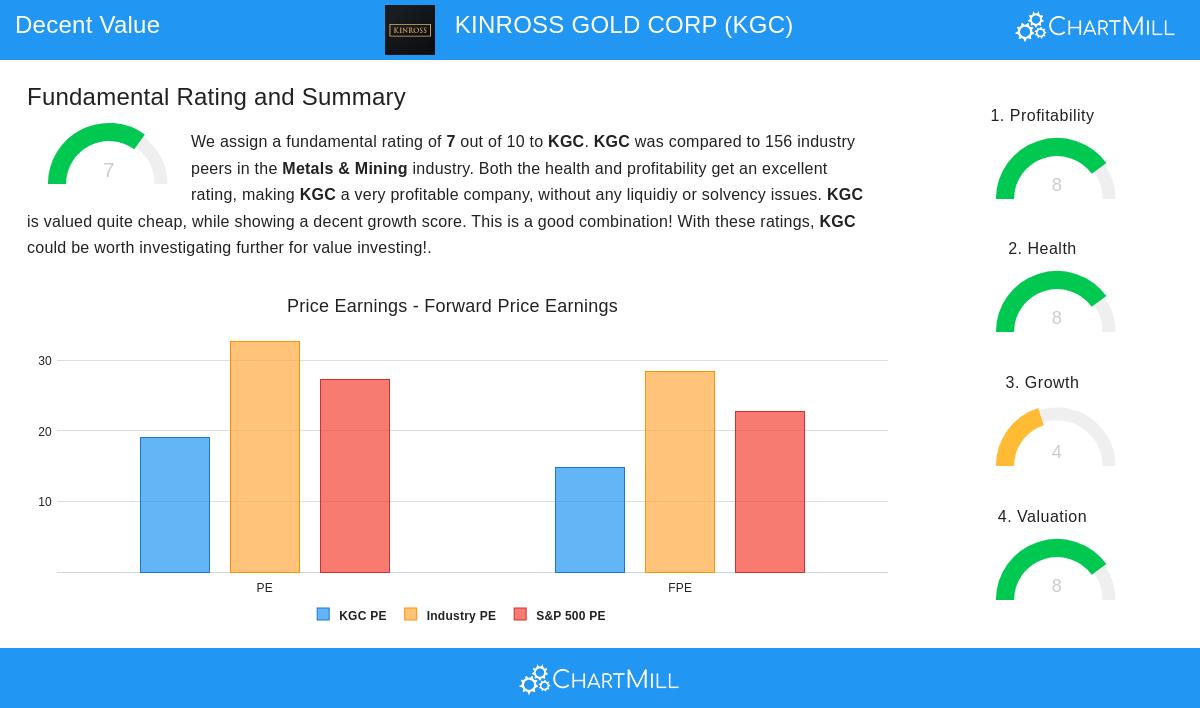

Kinross Gold Corp (NYSE:KGC) Fits the Decent Value Strategy with Attractive Valuation and Strong Fundamentals

The Decent Value investment strategy focuses on identifying companies that appear undervalued relative to their fundamental strength, combining attractive pricing with solid operational health. This approach seeks stocks with strong valuation metrics, such as low price-to-earnings or enterprise value multiples, while also maintaining good profitability, healthy financials, and reasonable growth potential. By emphasizing these criteria, investors aim to find opportunities where the market may not fully recognize a company’s intrinsic worth, offering a potential margin of safety and room for price appreciation as fundamentals are realized over time.

KINROSS GOLD CORP (NYSE:KGC) emerges as a candidate fitting this strategy, based on its fundamental profile. The company, which operates gold mining properties across North and South America, Africa, and other regions, shows a mix of value characteristics and operational strength that may appeal to investors screening for undervalued opportunities with sound underlying business metrics.

Valuation Metrics

Kinross Gold displays several indicators of attractive valuation, which is central to the value investing approach. A lower valuation relative to earnings, cash flow, or assets can signal that a stock is priced below its intrinsic value, offering a potential opportunity if market perceptions align with fundamentals over time.

- The company’s Price/Earnings ratio of 19.03 is below the industry average, placing it cheaper than 82% of its peers in the metals and mining sector.

- Its Enterprise Value to EBITDA and Price/Free Cash Flow ratios are also favorable, ranking better than approximately 81% and 91% of industry competitors, respectively.

- With a forward P/E of 14.83, Kinross is valued below the S&P 500 average, reinforcing its position as reasonably priced relative to broader market benchmarks.

These valuation metrics suggest the market may not be fully accounting for the company’s earnings and cash flow capacity, a key focus for value-oriented strategies looking for discrepancies between price and fundamental worth.

Financial Health

A strong financial health profile reduces risk and supports sustainability, which is crucial for value investors who often hold positions for longer periods. Kinross demonstrates several positive signs in this area.

- The company holds an Altman-Z score of 4.53, indicating low bankruptcy risk and outperforming 68% of industry peers.

- Its debt levels are manageable, with a Debt-to-Equity ratio of 0.18 reflecting limited reliance on borrowing, and a strong Debt-to-Free Cash Flow ratio of 0.72 showing capacity to cover obligations quickly.

- Liquidity metrics are mixed, but the company’s overall solvency and profitability provide a buffer against short-term challenges.

This financial stability aligns with the value investing emphasis on durable companies that can withstand market fluctuations and economic cycles.

Profitability

Profitability is a cornerstone of intrinsic value, as consistent earnings and cash generation support a company’s ability to grow and return value to shareholders. Kinross scores well on this front, with high margins and returns on capital.

- The company achieves a Profit Margin of 25.18% and an Operating Margin of 38.20%, outperforming over 90% of its industry competitors.

- Return on Assets and Return on Equity stand at 14.08% and 22.29%, respectively, placing Kinross in the top tier of its sector for efficiency and profitability.

- These metrics have shown improvement recently, with operating margin expansion and gross margin growth, indicating positive operational trends.

Good profitability not only supports the company’s current valuation but also provides a foundation for future performance, a key consideration in value investing frameworks.

Growth Considerations

While growth is secondary to valuation and health in many value strategies, a reasonable growth profile can enhance the investment case by providing catalysts for price appreciation. Kinross has delivered solid historical growth, though future expectations are more tempered.

- Over the past year, revenue grew by 34.40%, and earnings per share increased by 151.06%, reflecting strong operational performance.

- The five-year average growth in EPS and revenue is positive, at 14.87% and 8.04% per year, respectively.

- However, analysts project a decline in both earnings and revenue over the next few years, which may weigh on near-term sentiment and partially explain the current undervaluation.

For value investors, this mixed growth outlook highlights the importance of the margin of safety provided by low valuation and high profitability, as it offers protection if growth slows more than expected.

Conclusion

Kinross Gold Corp represents a potentially interesting opportunity for investors employing a value-oriented strategy, as it combines attractive valuation multiples with strong profitability and financial health. While growth expectations are modest, the company’s fundamental strengths, including high margins, low debt, and efficient capital use, suggest it may be undervalued relative to its operational quality. Value investors often look for such disconnects between market price and intrinsic worth, seeking to capitalize on eventual market recognition of a company’s true value.

For readers interested in exploring similar investment opportunities, additional stocks meeting the Decent Value criteria can be found using this pre-configured screen.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The content should not be interpreted as a recommendation to buy, sell, or hold any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.