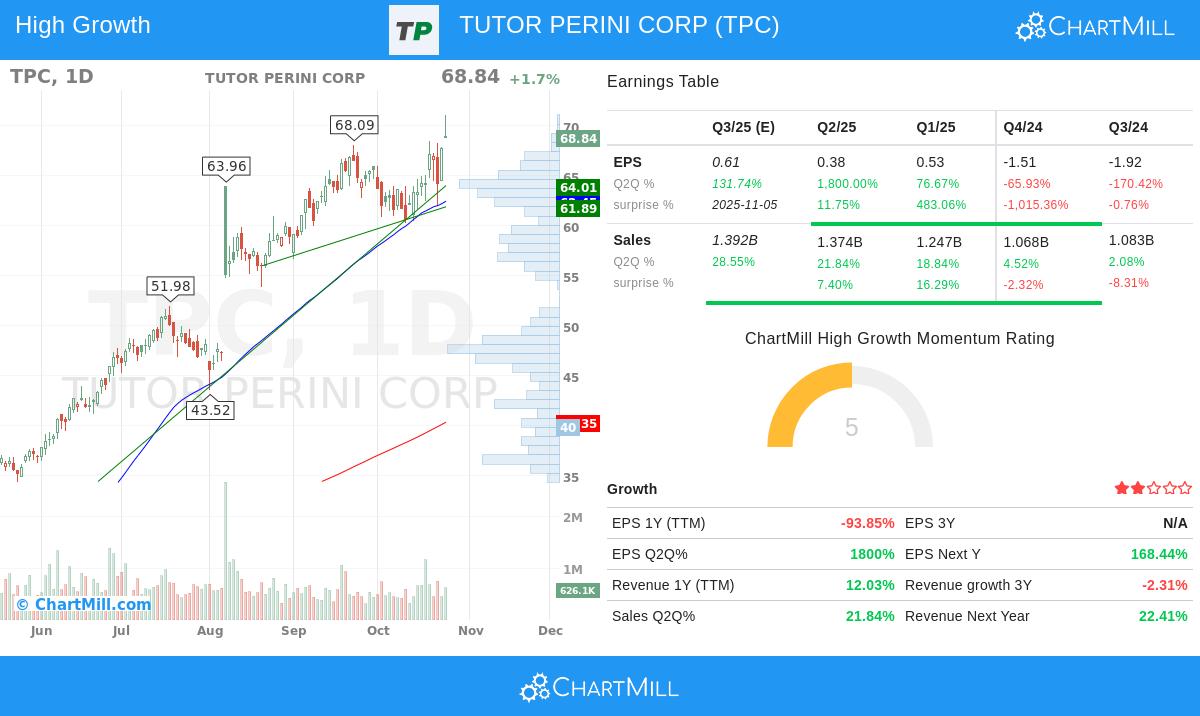

Tutor Perini Corp (NYSE:TPC) Screens as High-Growth Momentum Stock Using Minervini Trend Template

Tutor Perini Corp (NYSE:TPC) has recently appeared through a screening method combining Mark Minervini’s strict Trend Template with a High Growth Momentum filter. This two-part method finds companies displaying both solid technical momentum and basic fundamental growth traits, a feature of Minervini’s SEPA (Specific Entry Point Analysis) method. The plan looks for stocks in strong uptrends, verified by particular moving average positions and price movement, while also needing proof of improving business results to support additional price gains.

Technical Strength and the Trend Template

The Minervini Trend Template is made to find stocks in a confirmed Stage 2 uptrend, and TPC currently meets its main technical requirements. The system needs agreement across different time periods to confirm continued momentum, which is plainly visible.

- Price Above Key Moving Averages: The present price trades well above the increasing 50-day, 150-day, and 200-day simple moving averages. This shows strength across short, intermediate, and long-term time frames.

- Moving Average Position: The 50-day SMA ($62.45) is located above both the 150-day SMA ($45.58) and the 200-day SMA ($40.35), with the 150-day SMA also above the 200-day SMA. This ordered, positive position is a vital part of the Trend Template, showing organized buying pressure.

- Nearness to Highs: The stock is trading within 3% of its 52-week high of $71.07, meeting the template’s need of being within 25% of a new high. Stocks close to highs frequently have the momentum to keep rising.

- Major Recovery: The current price is about 275% above its 52-week low, greatly passing the template’s lowest requirement of 30%. This shows a strong trend change and continued buying interest.

- Better Relative Strength: With a ChartMill Relative Strength rating of 96.29, TPC is doing better than most of the market. Minervini stresses that real market leaders show high relative strength, often in the 80s or 90s, which TPC plainly shows.

This technical view indicates the stock is in a solid uptrend, a main idea of Minervini’s belief that “timing matters” and the best chances are in stocks already in a Stage 2 uptrend.

High Growth Momentum Fundamentals

Apart from the technical view, the screen selects for a High Growth Momentum (HGM) rating, looking for companies with improving business basics. TPC displays several encouraging signals of a fundamental recovery and growth improvement, which can serve as the reason for ongoing price performance.

- Large Quarterly EPS Growth: The latest quarter showed an earnings per share growth of 1,800% compared to the same quarter last year. While this starts from a low point, such a sharp change is a solid positive sign. The following quarter is also projected to grow by over 130%.

- Solid Revenue Improvement: Quarterly revenue growth has improved noticeably, from 2.08% three quarters ago to 21.84% in the last reported quarter. The next quarter is predicted for over 28% growth. This pattern of improving sales is an important measure for growth investors.

- Positive Analyst Changes: Analysts have grown more hopeful, increasing their EPS projections for the next year by over 16% in the last three months. Upward changes often come before continued positive price movement as institutional investors update their models.

- High Free Cash Flow Creation: The company is creating significant free cash flow per share of $10.70, which has grown over 1,170% in the past year. This gives financial room and can be a sign of future margin improvement and money put back into the business.

These fundamental gains match Minervini’s concentration on companies showing “big earnings” that “attract big attention.” The mix of a strong technical breakout and proof of a fundamental reason makes an interesting setup.

Technical Analysis Overview

The independent technical analysis for TPC is very strong. The stock gets a perfect ChartMill Technical Rating of 10, showing its steady outperformance and good patterns across all time frames. Both the short-term and long-term trends are rated as positive, and the stock is doing better than 96% of the market and 98% of its Construction & Engineering industry group. While the technical condition is very good, the present Setup Quality rating is a 4, indicating that after a strong price rise, the stock might be ready for a time of pause. The analysis notes that price action has been unstable recently, making a good entry point less obvious. A time of steadiness could offer a more certain chance for new investments.

A detailed technical report for TPC can be found here.

Finding Similar Opportunities

For investors curious about using this combined plan of the Minervini Trend Template and High Growth Momentum filters, new possible choices can be easily found.

You can find more stocks that meet these strict requirements by using this pre-configured screen.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice of any kind. The author has no position in TPC. All investment decisions involve risk, and you should conduct your own research and consult with a qualified financial advisor before making any investment decisions.