Alliant Energy Corp (NASDAQ:LNT) Emerges as a Notable Technical Breakout Candidate

Utility company Alliant Energy Corp (NASDAQ:LNT) has appeared as a notable technical breakout candidate according to a proprietary screening method. The screening method identifies stocks showing both good basic technical condition and consolidation patterns that indicate possible breakout chances. This two-part method first checks if a stock keeps positive momentum across several timeframes, then evaluates if its present price action offers a good risk-reward arrangement for entry.

Technical Strength Assessment

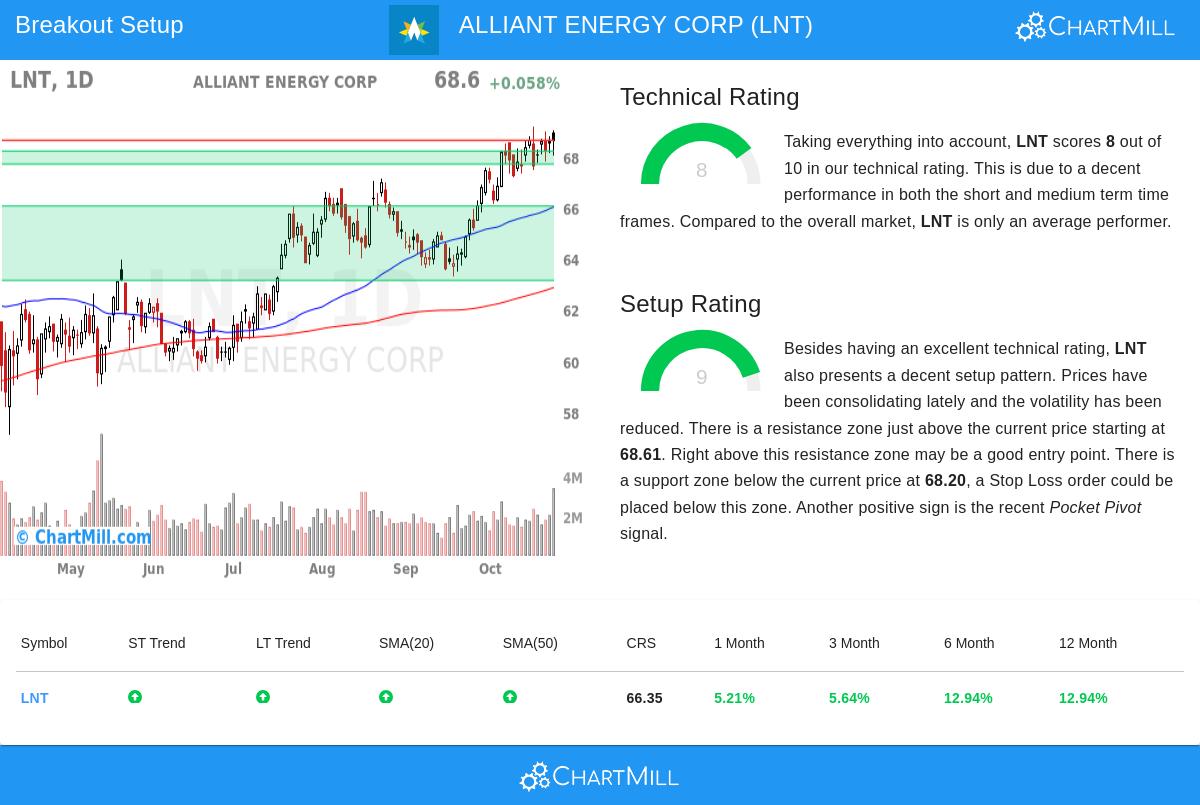

Alliant Energy shows good technical features that satisfy the screening requirements for breakout candidates. The stock’s Technical Rating of 8 out of 10 points to solid basic momentum, which is important for finding stocks with steady upward paths instead of temporary increases. This rating shows several good factors visible in the detailed technical report:

- Both short-term and long-term trends are clearly positive

- The stock is trading near its 52-week high of $69.16

- All major moving averages (20, 50, 100, and 200-day) are increasing

- Price stays positioned above these important moving averages

The mix of these factors indicates continued buying interest across different time periods. For technical investors, this steady pattern across several timeframes verifies the stock’s upward momentum is not limited to short-term changes but shows wider market belief in the utility’s performance.

Setup Quality Evaluation

Beyond good technicals, LNT shows a very good setup quality with a rating of 9 out of 10. This high score shows the stock has been moving in a narrow range, forming conditions good for a possible breakout. The setup study shows several interesting features:

- Prices have moved between $65.49 and $69.16 over the last month

- Volatility has reduced during this time of consolidation

- A distinct bull flag pattern has formed after recent gains

- A pocket pivot signal happened recently, pointing to institutional buying

The period of consolidation has formed specific support and resistance levels that allow for exact trade planning. This formation is especially useful for breakout traders looking for measurable risk factors instead of following overstretched moves.

Trade Structure and Risk Management

The technical setup presents clear levels for possible entry and exit points. Resistance is located between $68.61 and $68.63, while support is formed between $67.69 and $68.20. For traders using this plan:

- Entry could be thought about above resistance at $68.64

- Stop loss could be set below support at $67.68

- This forms a specific risk of about 1.40% on the trade

The fairly narrow risk factors, joined with the stock’s average true range of 1.41%, offer good risk-reward features for breakout traders. However, the closeness of the current price to resistance means traders should watch for real breakout confirmation instead of early entry.

Market Context and Industry Positioning

Inside the wider market situation where the S&P 500 shows positive trends across both short and long-term periods, LNT’s performance matches general market strength while displaying its own unique formation. The stock does better than 66% of all stocks over the past year and sits in the middle group of electric utility performers, doing better than 56% of industry competitors. This relative performance indicates the stock is not just following wider market trends but shows company-specific positive momentum.

Additional Breakout Opportunities

For investors looking for similar technical formations, more breakout candidates can be found using the Technical Breakout Setups screening tool. This resource constantly searches the market for stocks showing both good technical ratings and high-quality setup formations, giving continuous chances for technical traders.

Disclaimer: This analysis is based on technical indicators and pattern recognition and should not be considered investment advice. Always conduct your own research, consider your risk tolerance, and consult with a financial advisor before making investment decisions. Technical patterns do not guarantee future performance, and all trading involves risk including potential loss of principal.