CareTrust REIT INC (NYSE:CTRE) Analysis: A Combined Fundamental and Technical Review

A combined method for stock selection that uses both fundamental and technical analysis gives investors a full framework for finding possible opportunities. This method focuses on companies showing solid underlying business growth while also displaying positive price patterns. By filtering for stocks with good fundamental growth traits next to encouraging technical formations, investors try to match quality business performance with beneficial entry points. This two-part method tries to identify companies set for continued growth while possibly gaining from momentum and breakout patterns in their stock price movements.

Fundamental Growth Assessment

CareTrust REIT INC (NYSE:CTRE) shows positive growth traits that build the base of its investment appeal. The company’s fundamental growth profile is notable within the diversified REITs sector, with several indicators signaling continued expansion.

- Earnings Per Share growth of 108.47% over the past year

- Revenue expansion of 50.83% in the most recent fiscal year

- Projected EPS growth of 25.19% annually for coming years

- Expected revenue growth of 27.43% per year moving forward

The company’s growth path shows an increase in pace, with future projections above past performance levels. This drive is especially significant given CTRE’s place in the healthcare real estate sector, which gains from demographic trends and consistent demand drivers. The growth measurements point to management’s successful implementation of its acquisition and development plan within the skilled nursing and senior housing markets.

Profitability and Financial Health

Beyond growth measurements, CareTrust displays good profitability that adds to its expansion story. The company’s margin performance and returns on capital show efficient operations and effective use of capital.

- Profit margin of 58.73%, doing better than 97.64% of industry peers

- Operating margin of 66.50%, above 99.21% of sector competitors

- Return on assets of 4.71%, placed in the top 7% of the industry

- Return on invested capital of 4.38%, better than 83% of similar REITs

While the company keeps sufficient liquidity ratios and a careful debt-to-equity ratio of 0.35, investors should be aware that the financial health rating shows some worries about share dilution and capital efficiency. However, the overall profitability view stays positive, providing fundamental support for the growth story.

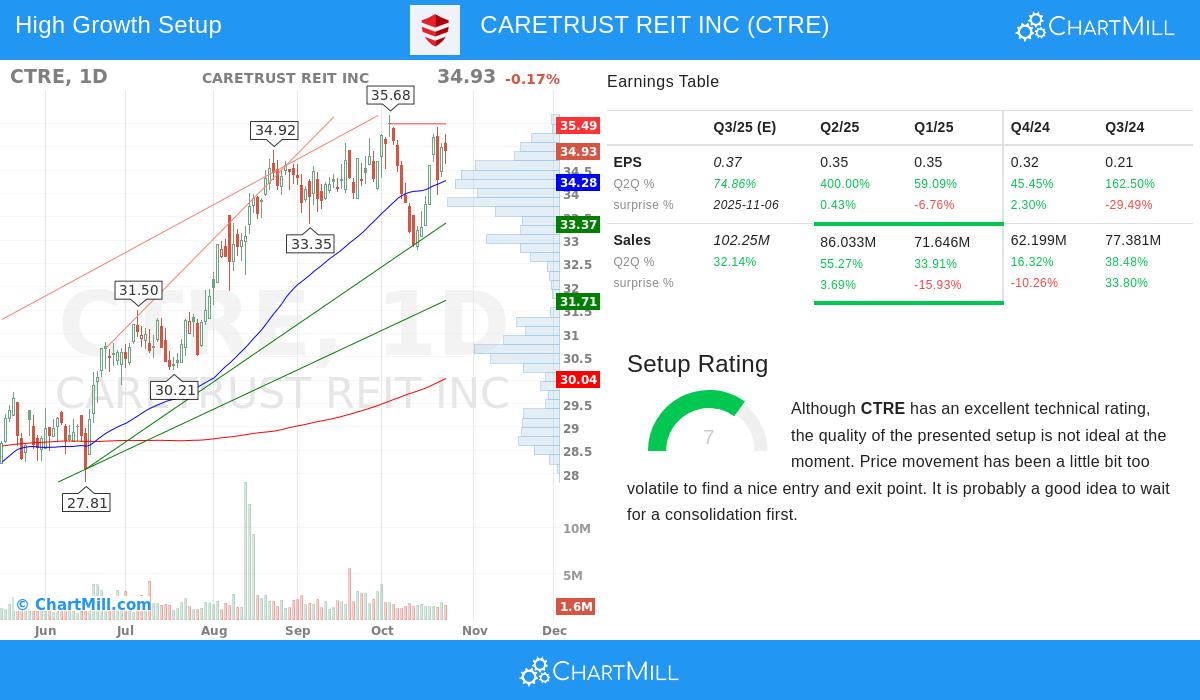

Technical Setup and Price Action

The technical view for CTRE adds to its fundamental positives, with the stock showing upward momentum across several timeframes. Current price movement indicates possibility for continued rise after recent consolidation.

- Both short-term and long-term trends stay positive

- Trading near 52-week highs along with broader market strength

- Several support levels set between $24.90 and $34.37

- Resistance zone found between $35.49 and $35.50

The stock’s relative strength does better than 72% of the broader market and 88% of diversified REIT peers, showing sector leadership. The technical formation indicates the stock is nearing a possible breakout level, with volume patterns supporting the price movement. The coming together of positive trends across daily and weekly timeframes gives technical confirmation of the fundamental growth story.

Valuation Considerations

CTRE’s valuation shows a mixed view that needs thoughtful review next to its growth prospects. While some standard measurements seem high, others point to fair pricing given the company’s growth path.

- P/E ratio of 28.40 matches S&P 500 average levels

- Forward P/E of 22.60 looks good next to industry averages

- Low PEG ratio shows payment for expected growth

- Enterprise value to EBITDA seems high compared to peers

The valuation review must be seen in the context of the company’s exceptional profitability margins and increasing growth profile. For growth-focused investors, the higher valuation might be acceptable due to the mix of solid fundamental performance and positive technical momentum.

Investment Implications

The matching of CTRE’s solid fundamental growth profile with good technical patterns makes a noteworthy opportunity for investors using a combined analysis method. The company’s place in the healthcare property sector gives exposure to demographic trends that support long-term growth, while the technical formation indicates possible short-term momentum.

The fundamental analysis report gives details on the full review of CTRE’s financial measurements, while the technical analysis gives information on price patterns and possible entry levels. Together, these reviews form a whole picture of the investment case.

For investors looking for similar opportunities that mix solid growth fundamentals with positive technical formations, more screening results can be found through our Strong Growth Stocks with Good Technical Setup Ratings screening tool.

Disclaimer: This analysis is given for informational purposes only and does not make up investment advice, recommendation, or endorsement of any security. Investors should do their own research and talk with financial advisors before making investment decisions. Past performance does not assure future results, and all investments carry risk including possible loss of principal.