Why Did Strategy Stock Spike Nearly 6% After-Hours?

- The Bitcoin treasury company reported earnings of $2.8 billion, or $8.42 per share, for the quarter ended Sept. 30, compared to a net loss of $340.2 million, or $1.72 per share, a year earlier.

- The company’s Bitcoin holdings rose to 640,808 in October, up from 597,325 at the start of the third quarter.

- Strategy Chair Michael Saylor said the company will remain focused on purchasing Bitcoin rather than pursuing any deal, even if it appears accretive.

Strategy (MSTR) stock gained 5.8% in extended trading on Thursday after it reported $2.8 billion in earnings in the third quarter, aided by gains in Bitcoin prices.

The Bitcoin treasury company reported earnings of $2.8 billion, or $8.42 per share, for the quarter ended Sept. 30, compared to a net loss of $340.2 million, or $1.72 per share, a year earlier. Strategy records the changes in the fair value of the Bitcoin it holds to measure its net income, making it highly prone to volatility.

Strategy’s gains came amid a rise in Bitcoin prices to about $114,000 by the end of September, up from approximately $107,000 at the beginning of July. The company’s Bitcoin holdings rose to 640,808 in October, up from 597,325 at the start of the third quarter.

In its software segment, total revenue rose nearly 11% to $128.7 million year over year, driven by a jump in subscription revenue. In 2020, the company pioneered the strategy of holding Bitcoins in its balance sheet and now issues credit instruments with ‘ROC’ (return of capital) dividends based on its holdings.

Strategy Reaffirms Annual Targets

The Tysons Corner, Virginia-based firm reiterated its expectations to achieve $80 per share in earnings in 2025 and $34 billion in operating income. It also expects to net a so-called Bitcoin yield of 30% this year, compared with 26% year-to-date. Bitcoin yield is a key performance indicator that represents the percentage change in the ratio of the company’s bitcoin holdings to its outstanding shares from period to period.

Earlier this week, Strategy, formerly known as MicroStrategy, became the first-ever Bitcoin treasury company to be assigned a credit rating, after it notched a B- rating from S&P.

“Over time, our hope is [that] if Bitcoin was to be treated as a true capital on our balance sheet, that we would be considered an investment-grade rated company,” said CEO Phong Le in a call with analysts after noting that the company has already seen U.S. banks and mortgage companies consider using Bitcoin as collateral.

What Is Retail Thinking?

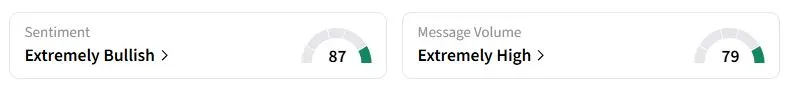

Retail sentiment on Stocktwits about Strategy was in the ‘extremely bullish’ territory at the time of writing, compared with ‘neutral’ a day ago, while retail message volume surged to ‘extremely high’ from ‘normal’ a day ago. It was also the top trending ticker on the social media platform.

“Short squeeze tomorrow would be absolutely amazing,” one user wrote.

“Huge quarter!! I don’t think most people understand this company. Simply incredible! Their pipeline of innovation is amazing. I expect this stock to double within 6 months!” another user said.

Saylor Says Focus Remains On Bitcoin Purchases, Not M&A

Strategy Chair Michael Saylor said the company will remain focused on purchasing Bitcoin rather than pursuing any deal, even if it appears accretive.

“There’s just a lot of uncertainty, and these things tend to stretch out 6 to 9 months or a year, and an idea that looks good when you start, it might not still be a good idea 6 months later, and it can be very distracting for the management team,” Saylor said.

The company is also planning to launch new credit instruments in international markets rather than dollar-backed ones, Saylor said, to fulfill Strategy’s global ambitions.

Also See: Why Did First Solar Stock Jump 5% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.